Medicare Graham Fundamentals Explained

Searching for the appropriate Medicare plan can be a little difficult, but it doesn't need to be made complex. It's all about being well-prepared and covering your bases. You intend to start your journey as notified as feasible, so you can make the very best choice - Medicare South Florida. This suggests asking the appropriate concerns regarding protection, Medicare strategy networks and medical professionals, plan advantages and even more.

Before we speak about what to ask, let's speak about who to ask. There are a great deal of methods to authorize up for Medicare or to get the information you require prior to selecting a strategy. For several, their Medicare trip starts directly with , the main internet site run by The Centers for Medicare and Medicaid Services.

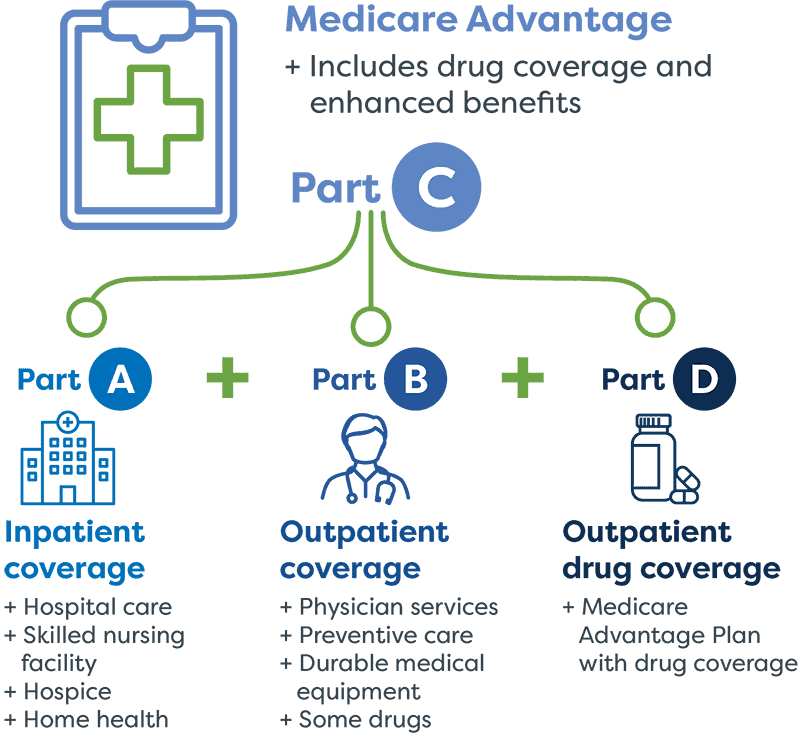

It covers Part A (hospital insurance) and Component B (clinical insurance). This consists of points that are considered medically required, such as health center stays, routine medical professional visits, outpatient solutions and more. is Medicare protection that can be bought directly from a private healthcare business. These plans work as an alternative to Original Medicare while supplying even more benefits - Medicare South Florida.

Medicare Component D prepares aid cover the price of the prescription drugs you take in your home, like your everyday medications. You can enlist in a separate Part D plan to include drug coverage to Original Medicare, a Medicare Price plan or a couple of various other sorts of strategies. For lots of, this is frequently the first question thought about when browsing for a Medicare plan.

The 2-Minute Rule for Medicare Graham

To get one of the most cost-effective healthcare, you'll want all the solutions you utilize to be covered by your Medicare plan. Some covered services are totally free to you, like mosting likely to the medical professional for preventive treatment screenings and examinations. Your strategy pays every little thing. For others like seeing the medical professional for a sticking around sinus infection or filling up a prescription for covered prescription antibiotics you'll pay a charge.

and seeing a service provider who accepts Medicare. What about traveling abroad? Many Medicare Advantage strategies supply worldwide insurance coverage, as well as insurance coverage while you're traveling locally. If you prepare on taking a trip, ensure to ask your Medicare expert about what is and isn't covered. Possibly you've been with your present medical professional for some time, and you wish to maintain seeing them.

A Biased View of Medicare Graham

Lots of people who make the switch to Medicare continue seeing their normal physician, but also for some, it's not that simple. If you're working with a Medicare advisor, you can ask if your physician will certainly be in connect with your new plan. If you're looking at strategies independently, you might have to click some web links and make some telephone calls.

For Medicare Benefit plans and Cost plans, you can call the insurance provider to see to it the medical professionals you desire to see are covered by the plan you have an interest in. You can likewise inspect the plan's website to see if they have an online search device to discover a covered medical professional or facility.

Which Medicare strategy should you go with? Beginning with a list of factors to consider, make sure you're asking the right inquiries and begin concentrating on what type of strategy will best offer you and your requirements.

Not known Facts About Medicare Graham

Are you concerning to turn 65 and come to be recently eligible for Medicare? The least expensive plan is not necessarily the finest choice, and neither is the most pricey plan.

Even if you are 65 and still functioning, it's a great idea to evaluate your alternatives. Individuals getting Social Protection advantages when transforming 65 will certainly be instantly enlisted in Medicare Components A and B. Based on your employment situation and healthcare alternatives, you might need to take into consideration enlisting in Medicare.

Then, think about the different kinds of Medicare plans offered. Original Medicare has 2 parts: Component A covers a hospital stay and Component B covers clinical expenditures. However, lots of people locate that Components A and B together still leave gaps in what is covered, so they buy a Medicare supplement (or Medigap) plan.

What Does Medicare Graham Mean?

There is generally a costs for Component C policies in addition to the Component B premium, although some Medicare Benefit plans deal zero-premium plans. Medicare Lake Worth Beach. Testimonial the insurance coverage information, costs, and any fringe benefits used by each strategy you're thinking about. If you register in original Medicare (Parts A and B), your premiums and insurance coverage will coincide as other individuals that have Medicare

Comments on “The Single Strategy To Use For Medicare Graham”